Impact of Future Price on Spot Price of Indian Stock Market

DOI:

https://doi.org/10.31033/ijemr.13.2.28Keywords:

Derivatives Market, Future Price, Spot Market, Regression AnalysisAbstract

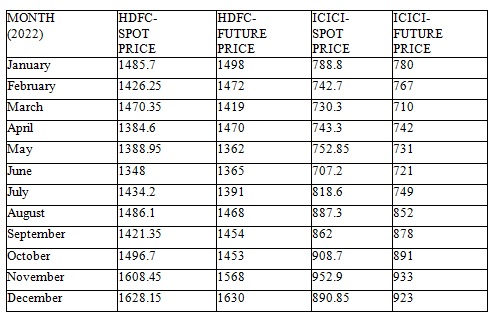

This paper examines the impact of future trading on spot price volatility by using regression Analysis. The main objective of this paper is to investigate whether the existence of future markets in India has improved the rate at which new information is impounded into spot prices and have any persistence effect. The results gathered from the study indicate that even though it has been in operation for a short period of time, the futures market in India has significantly increased the rate at which new information is transmitted into spot prices and that it has reduced the persistence of information and volatility in underlying spot market resulting in improved efficiency. The results of this study have also some important implications for policy makers discussed in the final section of this paper.

Downloads

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Dr. Swati Mehta

This work is licensed under a Creative Commons Attribution 4.0 International License.