Prediction of Loan Approval in Banks using Machine Learning Approach

DOI:

https://doi.org/10.31033/ijemr.13.4.2Keywords:

Safe Customers, Bank Loans, Trained Dataset, Random Forests, KNN, Decision Tree, Naive BayesAbstract

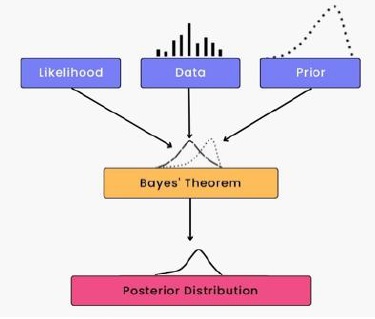

Due to significant technology advancements, people's needs have expanded. As a result, there have been more requests for loan approval in the banking sector. A few qualities, taken for consideration, when choosing a candidate for loan approval in order to, determine loan's status. Banks face a major challenge; when it, comes to assessing loan applications and lowering the risks associated with potential borrower defaults. Since they must thoroughly evaluate each borrower's eligibility for a loan, banks find this process to be particularly challenging. This research proposes combining machine learning (ML) models and ensemble learning approaches to find the probability of accepting individual loan requests. This tactic can increase the accuracy with which qualified candidates are selected from a pool of applicants. As a result, this method can be used to address the problems with loan approval processes outlined above. Both the loan applicants and the bank employees profit from the strategy's dramatic reduction in sanctioning time. Because of the banking industry's expansion, more people were applying to loans at banks. In order to predict the accuracy of loan approval status for applied person, we used four different algorithms namely Random Forest, Naive Bayes, Decision Tree, and KNN. By using these, we obtained better accuracy of 83.73% with Naïve Bayes algorithm as best one.

Downloads

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Viswanatha V, Ramachandra A.C, Vishwas K N, Adithya G

This work is licensed under a Creative Commons Attribution 4.0 International License.