Volatility Response to “Black Swan Event” of Covid-19 in Asian Stock Market: An Empirical study Using EGARCH Model

DOI:

https://doi.org/10.31033/ijemr.13.4.10Keywords:

Volatility, Covie-19, EGARCH, Black SwanAbstract

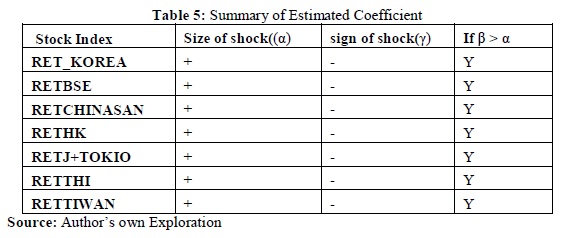

By detailing the volatility response to shocks in several Asian nations, a dimension that has not been examined in the existing literature, our study contributes to the body of literature. The empirical data from the study indicate that volatility displayed asymmetric behavior in a few select Asian stock markets over the study period. In relation to this study, we saw that the volatility reaction followed a consistent pattern in the Asian region. For all but a few select markets, shocks are homogeneous in size and sign. Additionally, there is evidence that volatility responses are persistent across all Asian stock markets, which suggests that the impact of volatility will gradually diminish. This study offers helpful information to the investor community to help them make informed decisions about their investments.

Downloads

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Dr. Neeru Gupta

This work is licensed under a Creative Commons Attribution 4.0 International License.