The After Market Performance Analysis of Initial Public Offering in Bangladesh: Short Run and Long Run

DOI:

https://doi.org/10.31033/ijemr.13.6.8Keywords:

Adjusted Return, Cumulative Wealth Relative to Index, DSE, Initial Public Offering, Holding Period, Return, JEL Classification, Codes: G11, G12Abstract

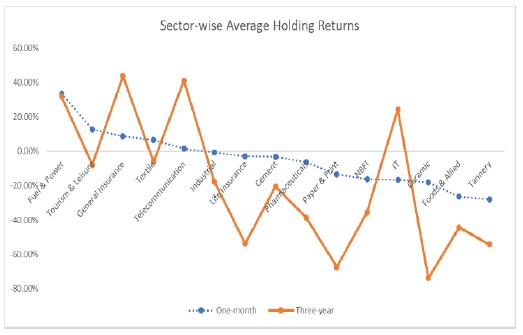

This article investigates both short and long run performance of 113 IPOs listed on Dhaka Stock Exchange between 2008 and 2019. It examines short run performance to validate the anomaly of short run abnormal returns of stocks. The IPO stocks in the secondary market have underperformed in the three-year long run period and outperformed in the short run. The portfolio of IPO stocks has surpassed the DSEX by 1.17 percent in the short run and underperformed by -26.53 percent in the long run. Apart from these, the variation in the returns of sectors has also been analysed. Even though the overall portfolio underperformed, some sectors have outrun the index by a large margin. Insurance and telecommunication are among the outperforming sectors. Food & allied, Ceramic and Paper & print sectors have always underperformed the market severely. The core reasons behind these anomalies have not been researched in this study, further analysis can be done on this aspect. Variations in the sector-wise returns can also be identified by further investigation.

Downloads

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Palash Saha

This work is licensed under a Creative Commons Attribution 4.0 International License.