Taxation, Debt Burden and Economic Growth in Nigeria

DOI:

https://doi.org/10.31033/ijemr.13.6.23Keywords:

Taxation, Debit, Economic GrowthAbstract

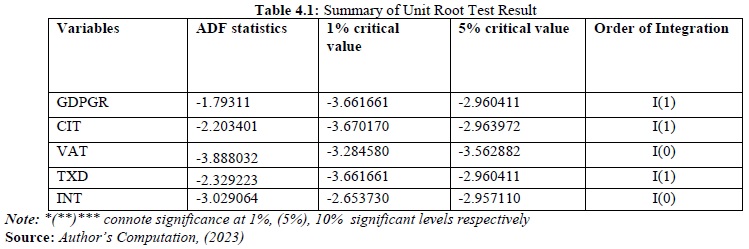

This study examined the relationship among taxation, debt burden and economic growth in Nigeria. Specifically, it investigated the effect of company income tax; value added tax and external debt on GDP growth rate in the country. The study made use of annual data that covered the period of 33 years between 1990 and 2022 and data for this research were sourced from Central Bank of Nigeria (CBN) statistical bulletin (2022). The study employed Autoregressive Distributed Lag (ARDL) co-integration approach as research technique to estimate the model of this work. The result showed that company income tax and debt burden have significant negative impact on gross domestic product growth rate in Nigeria. The result also revealed that VAT has significant positive impact on gross domestic product growth rate in the country. In line with these findings, it was concluded that debt burden effect is not favourable in boosting growth in Nigeria. Therefore, this study recommends that government should make sure that debt acquired is spent on capital projects rather than consumption activities in order to engender greater productivity and expansion. Moreover, government of Nigeria needs to intensify more efforts to ensure proper control and prevention of corruption so as to enhance economic growth and development through taxation and debt.

Downloads

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Awe Folashade Deboreah (Ph.D), Oluwaseye Rufus Adeleye, Olawunmi Samson Dare

This work is licensed under a Creative Commons Attribution 4.0 International License.