A Comprehensive Study on Goods and Services Tax in India

DOI:

https://doi.org/10.5281/zenodo.10675765Keywords:

Goods and Service Tax, Value Added Tax,, GSTNAbstract

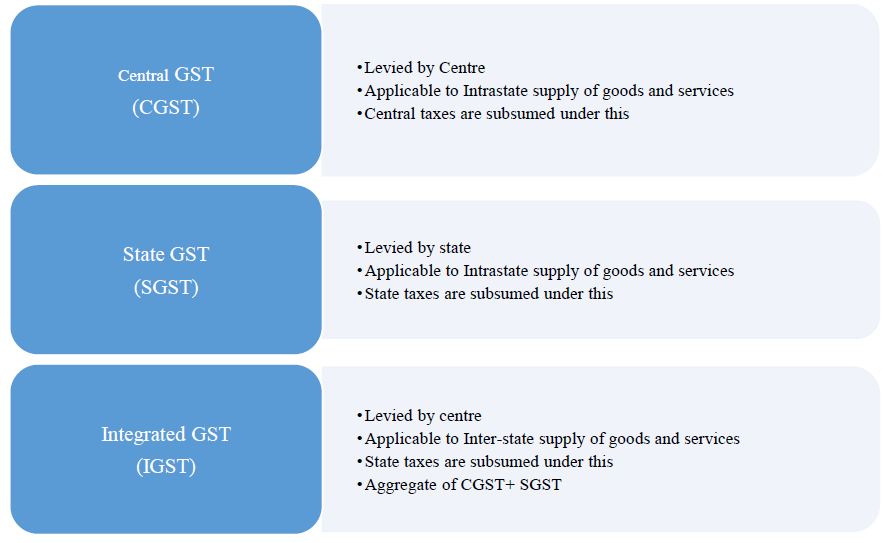

The Goods and Service Tax [GST] is implemented by the Government of India on 1st July 2017 through the one hundred and first amendment of the constitution of India. It was marked a significant shift in the country's taxation landscape. GST, which is publicized as the one nation one tax, brought with its expectations of free flowing of credit, subsequent to reduction in prices of goods and services as well as free movement of goods in India. In view of the changes, it brought to the tax system, it may be early to pass a final judgment on its achievement. While GST has streamlined the tax regime and promoted economic integration, its full potential is yet to be realized, requiring continuous reforms and adaptations to address challenges and capitalize on opportunities for sustainable growth. This paper tries to trace the historic journey of GST in India and take a look at the experience of Government and businesses in their initial years of GST implementation.

Downloads

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Rani Jacob, Karthika Binu, Anjana P B

This work is licensed under a Creative Commons Attribution 4.0 International License.