Forecasting Stock Prices through Time Series, Econometric, Machine Learning, and Deep Learning Models

DOI:

https://doi.org/10.5281/zenodo.10688767Keywords:

Temporal Sequences, Econometric Analysis, Statistical Regression, Advanced Learning, Exponential Smoothing using the Holt-Winters Method, ARIMA, Multivariate Adaptive Regression Splines (MARS), Recurrent Neural Networks (RNN) and Long Short-Term Memory (LSTM), Predictive Modeling of Stock PricesAbstract

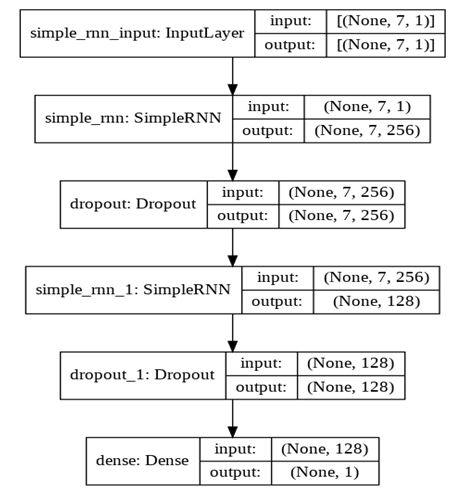

Over an comprehensive ending, scientist have loyal solid efforts to plan a strong and exact predicting foundation for guessing stock prices. Academic discourse emphasizes that intricately devised and refined predicting models occupy the competency to carefully and dependably expect future stock principles. This case introduces a various array of models, including methods to a degree period succession reasoning, econometrics, and miscellaneous knowledge-based approaches tailor-made for stock price guess. Analyzing dossier connecting from January 2004 to December 2019 for famous enterprises to a degree Sun Pharma Group, ICICI Bank, and Infosys Technologies, the models suffered rigorous preparation and estimate to judge their influence across various labors. This research engages a unique mixture of methodologies, containing an individual occasion order models , an econometric approach (ARIMA model), and a pair of machine intelligence model like MARS and Random Forest. Additionally, the study integrates two deep knowledge- located models, particularly the plain RNN and LSTM. This diverse array of models aims to supply a inclusive study of stock price activities vague areas. The study results emphasize the preeminence of Multivariate Adaptive Regression Splines (MARS) as the most able machine intelligence model, Short-term memory (LSTM) has emerged as a deep learning model. Importantly, MARS usually illustrates superior influence in the specific domain of transactions guessing across the Information Technology (resorting to Infosys dossier), Banking (illustration upon ICICI dossier), and Health (depending SUN PHARMA dossier) sectors.

Downloads

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Anand Kumar Dohare, Mohammad Abuzaid

This work is licensed under a Creative Commons Attribution 4.0 International License.