The State of Income Tax on Rent in Zambia: The Way Forward

DOI:

https://doi.org/10.5281/zenodo.10909095Keywords:

Withholding Tax, Revenue, Property, Zambia Revenue AuthorityAbstract

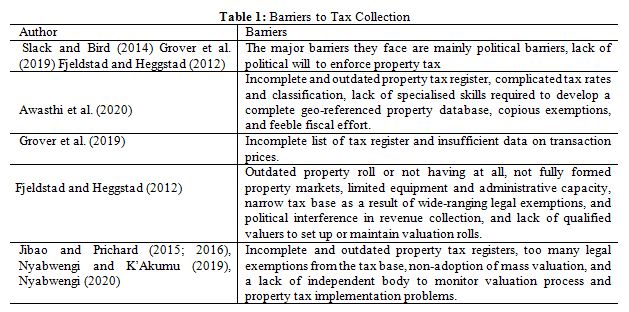

The aim of the study was to develop a framework of measures that could be employed by The Zambia Revenue Authority (ZRA) to increase revenue from house rentals. A qualitative phenomenological study involving ZRA staff was employed. Data was collected using in-depth interviews and future search conference techniques (presentations, discussions at plenary sessions and document review). Data was analysed using modified content analysis which has an extension of Katherine Charmaz’s Constructivist Grounded Theory. In this sense, the research focused on the meanings attributed by the participants to the research phenomenon and in this case Rental Income Tax. The main findings in this study are that the quantum of the tax that is remitted by the tax payer was based on a self-assessment estimate principle. ZRA did not assess property, not even the lease agreement to ensure that it received a commensurate quantum of the Tax. As from January 2022, the authority changed the Income Tax Rental (ITR) liability which initially was placed on the tenant to the landlord. The landlord as an income earner is now mandated to remit the rental tax as Rental Income Tax (RIT). There are several barriers that influenced tax compliance including the low tax knowledge by the citizenry, the perception of equity and fairness, low citizenry tax education, cultural factors where the citizenry are not committed to pay taxes, tax under-declaring and poor record keeping. Following a change in targeting tenants to landlords, the month-on-month income figures for the tax from the time it was changed, self-withholding tax in 2023 has increased. The study concludes that RIT is not being paid as expected because there are barriers on the tax payer’s and ZRA sides. There are a number of viable ways that have been proposed to break ground as far as reaching out to all landlords. This tax collection system should be imposed in general and evenly. This principle of justice must always be upheld and used as an absolute requirement for tax collectors to achieve prosperity in society.

Downloads

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Muziya Mutungwa, Erastus Mwanaumo

This work is licensed under a Creative Commons Attribution 4.0 International License.