Exploring Factors Influencing the Financial Success of Public and Private Life Insurers in India

DOI:

https://doi.org/10.5281/zenodo.10909208Keywords:

Indian Insurance Sector, Financial Success, Public and Private Insurers, Workforce SizeAbstract

Purpose - This research aims to comprehensively explore the factors that impact the financial success of commercial & public life insurers in India. Going beyond conventional metrics, the study incorporates non-monetary indicators such as client centric, growth, and social value. It also delves into often overlooked external factors impacting insurance companies and considers the differences in the functioning of commercial & public life insurers.

Design/Approach – This research adopts a systematic sampling framework, selecting 10 life insurance firms, which comprises the state-owned giant Life insurance corporation of India (LIC) as well as, nine commercial insurers. Data is collected over a five-year period (2015-16 to 2019-20) from various secondary sources, including published literature, annual reports, and regulatory documents. Both descriptive and hypothesis testing including multiple linear regression and correlation analyses, are employed to assess the significance of cash flow/ liquidity, leverage, solvency and workforce size on financial performance.

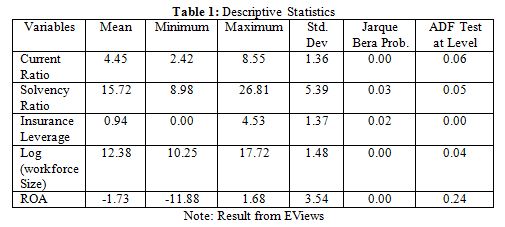

Findings -Descriptive statistics highlight variations in mean values among the selected variables, emphasizing their significance in determining financial performance. Correlation analyses reveal weak associations among variables, while regression analysis indicates that current ratio and size significantly impact profitability. Notably, public and private insurers show differences in Return on Equity and Expense Ratio, while no significant difference exists in Return on Assets.

Research Limitations – While the study has valuable contribution, it’s important to consider its limitations. The analysis relies on secondary data, and the sample size, though systematic, is relatively small. Additionally, the study’s findings may not be applicable to life insurers in other regions due to its focus on India.

Practical implication- The findings provide actionable insights for practitioners in the insurance industry,

offering guidance on enhancing profitability through attention to liquidity and workforce size. The findings identify the key drivers of profitability for life insurers in the current market. Regulatory bodies can leverage these insights to foster a healthy competitive environment in Indian life insurance companies.

Downloads

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Spoorthy Reddy M, Michael Yuivamung Zimik

This work is licensed under a Creative Commons Attribution 4.0 International License.