A Study of the Effect of Firm Size on the Financial Performance of LuSE Listed Companies

DOI:

https://doi.org/10.5281/zenodo.10999197Keywords:

Firm Size, Firm Performance, Total Assets, Total Debt, Total EmployeesAbstract

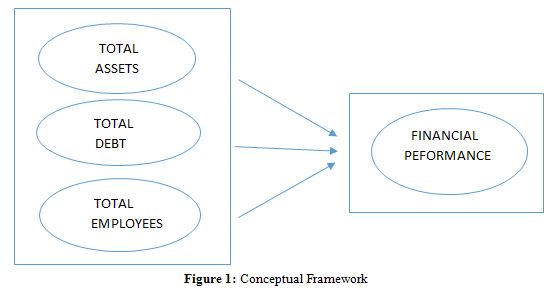

The Zambian Economy has gone through various financial changes in the recent past. The economy is a growing economy with great potential to expand to great heights. The Lusaka Stock Exchange (LuSE) plays a crucial role in how the economy is faring. Although it has been recording poor liquidity rates, it has since listed a total number of 24 firms since inception. These firms, their size and performance play a crucial role in understanding how both internal and external functions are aligning. The size of a firm has proven to be an important characteristic especially in these modern times where competition is at its all-time high. The research aimed to investigate this topic and determine what models, policies or procedures different sized firms should undertake in-order to survive. The main objective of this study was to evaluate if there a relationship between firm size and financial performance. The target population of this study was all the firms listed on the financial sector of the Lusaka Stock Exchange. The data collected spanned a period of 10 years- from 2012 to 2022. The three independent variables; total debt, total assets and total number of employees measured firm size while the dependent variable- Return on Assets (ROA), measured financial performance. The relationship between the independent variables and the dependent variable were found to be all statistically significant in the long run. However, total assets were found to be statistically insignificant in the short run. The study therefore concludes that firms with more assets, more employees and less debt are more likely to enjoy greater financial profitability in their long run periods. This implies that a positive relationship is expected between the size of the firm and the profitability levels. The association between the two is positive when ROA is employed as the proxy for firm performance.

Downloads

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Pumulo Maila, Kiru Sichoongwe

This work is licensed under a Creative Commons Attribution 4.0 International License.