An Analysis on Contribution of All India Refinancing Institutions in SME, Housing and Agricultural and Rural Development: Case of India

DOI:

https://doi.org/10.5281/zenodo.12897235Keywords:

All India Refinancing Institutions, NABARD, SIDBI, NHB, MSME, ARIAbstract

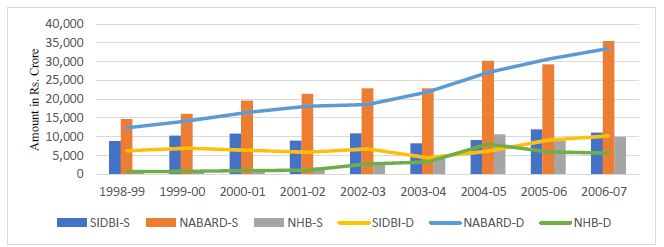

This research work examines assistance sanctioned and disbursed by the All India Refinancing Institutions contributed to development finance from 1984 to 2023. The financial assistance sanctioned and disbursed for development finance is the base information that is retrieved from different annual reports of RBI, NABARD, SIDBI and NHB. A simple descriptive technique is used to obtain the results, address the gap and satisfy the defined objectives. The output revealed that AIRFI has been maintaining its growth trends i.e. average growth rate of sanction and disbursement is sixteen and fifteen per cent respectively. The average unused fund is also at eight per cent which is at benchmark and under control. The thirty-nine years annual average sanction and disbursement growth rate at 0.41 and 0.39 per cent p.a. respectively, and the annual unused fund percentage growth rate at 0.22 per cent p.a. which is also at the benchmark. At the firm level, the continuous better contribution of NABARD in the last thirty-nine years for agriculture and rural sector growth is outstanding. The contribution of SIDBI and NHB is also very good for MSME and housing sector growth. Although the ratio of unused funds to the sanctioned amount of SIDBI is high during this period, it should be addressed by the government. If the union government want more growth from these sectors additional financial facilities are required to strengthen NABARD, SIDBI and NHB for further growth. Other financial institutions must understand the working mechanism of AIRFI to compete in the competitive world.

Downloads

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Pankaj Kumar

This work is licensed under a Creative Commons Attribution 4.0 International License.